Table of Contents

Introduction

Cryptocurrency mining is a way to earn digital currencies like Bitcoin and Ethereum. It plays a big role in today’s digital economy. This guide will explain what cryptocurrency mining is, how it works, and what you need to begin. We will cover the basics, the different types of mining, and the equipment required.

You’ll also learn about the costs involved, the environmental impact, and the legal aspects. By the end, you’ll have a clear understanding of cryptocurrency mining and how to start your own mining setup.

What is Cryptocurrency Mining?

Cryptocurrency mining is the process of verifying transactions on a blockchain. When you mine, you use special hardware to solve complex math problems. These problems help confirm that transactions are legitimate and keep the network secure. In return for your work, you get rewarded with cryptocurrency.

This reward can come in the form of new coins or transaction fees. Mining is crucial because it helps maintain the decentralized nature of cryptocurrencies, ensuring that no single entity controls the network. By participating in mining, you contribute to the overall health and security of the blockchain.

How Does Cryptocurrency Mining Work?

Cryptocurrency mining is a key part of how digital currencies operate. It’s the process that verifies and adds transactions to the blockchain, a public ledger that records all cryptocurrency activities. Here’s a detailed look at how it works.

The Mining Process Explained

Cryptocurrency mining involves several steps. Here’s a breakdown:

- Transaction Verification: When people make transactions using cryptocurrency, these transactions are grouped together into a block. Miners need to verify these transactions to ensure they are legitimate and not fraudulent.

- Solving Mathematical Puzzles: Miners use their hardware to solve complex mathematical puzzles. These puzzles are difficult to solve but easy to verify once solved. This process is known as Proof of Work (PoW). Solving these puzzles requires a lot of computational power and energy.

- Adding Blocks to the Blockchain: Once a miner solves the puzzle, the block of verified transactions is added to the blockchain. This blockchain is a chain of blocks, each containing transaction data. It’s a decentralized ledger that anyone can access.

- Earning Rewards: The miner who solves the puzzle first gets rewarded with cryptocurrency. This reward can be in the form of new coins (block reward) or transaction fees from the transactions included in the block.

Mining Algorithms

Different cryptocurrencies use different algorithms for mining. Here are two common ones:

- SHA-256: Used by Bitcoin, this algorithm requires miners to solve complex hash functions. It’s secure but requires a lot of energy.

- Ethash: Used by Ethereum, this algorithm is designed to be memory-hard. It requires miners to use their computer’s memory to solve puzzles, making it resistant to ASIC miners.

Proof of Work (PoW) vs. Proof of Stake (PoS)

There are different methods for verifying transactions. The two most common ones are Proof of Work (PoW) and Proof of Stake (PoS).

- Proof of Work (PoW): This is the traditional method where miners compete to solve mathematical puzzles. The first one to solve it gets to add the block to the blockchain and earn the reward. PoW requires a lot of electricity and powerful hardware.

- Proof of Stake (PoS): This method doesn’t involve solving puzzles. Instead, validators are chosen based on the number of coins they hold and are willing to “stake” as collateral. PoS is more energy-efficient than PoW but requires holding a significant amount of cryptocurrency.

Example Table: PoW vs. PoS

| Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Energy Consumption | High | Low |

| Hardware Requirements | Expensive (ASIC, GPU) | Less expensive |

| Reward Mechanism | Solving puzzles | Holding and staking coins |

| Security | High | High |

| Popular Cryptocurrencies | Bitcoin, Litecoin | Ethereum 2.0, Cardano |

Cryptocurrency mining is a process that verifies transactions and adds them to the blockchain. It involves solving complex puzzles, earning rewards, and securing the network.

While it has significant benefits like earning cryptocurrency and maintaining network security, it also faces challenges such as high costs and environmental impact. Understanding these aspects can help you decide if mining is right for you.

Types of Cryptocurrency Mining

Cryptocurrency mining can be done in different ways. Each method has its pros and cons. Here are the main types of crypto mining: solo mining, pool mining, and cloud mining.

Solo Mining

Solo mining means you mine by yourself. You use your own hardware and try to solve the puzzles on your own.

Pros:

- Full Rewards: You get to keep all the rewards since you’re not sharing with anyone.

- Control: You have full control over your mining operations and decisions.

Cons:

- High Costs: You need to buy and maintain all the hardware yourself. This can be very expensive.

- Low Success Rate: The chances of solving the puzzle and getting the reward on your own are much lower compared to mining in a group.

Pool Mining

Pool mining is when you join a group of miners. Everyone combines their computing power to solve puzzles faster. When the pool solves a puzzle, the reward is split among all the members based on their contribution.

Pros:

- Higher Success Rate: By combining forces, you increase your chances of solving the puzzle and earning rewards.

- Lower Costs: You share the costs of mining with others in the pool.

Cons:

- Shared Rewards: The rewards are split among all members of the pool, so you get a smaller share.

- Pool Fees: Some pools charge fees for joining and participating.

Cloud Mining

Cloud mining is when you rent mining hardware from a company. You pay a fee, and the company handles the mining process for you. You get a share of the rewards based on your investment.

Pros:

- No Hardware Needed: You don’t need to buy or maintain any hardware. The company takes care of everything.

- Easy to Start: It’s easy to get started with cloud mining. You just sign up and start mining.

Cons:

- Lower Profits: The company takes a cut of the profits, so you earn less compared to owning your hardware.

- Scams: There are many scams in cloud mining. It’s important to choose a reputable company.

Comparison Table: Solo Mining vs. Pool Mining vs. Cloud Mining

| Feature | Solo Mining | Pool Mining | Cloud Mining |

|---|---|---|---|

| Hardware Costs | High | Shared | None |

| Success Rate | Low | High | Varies |

| Rewards | Full | Shared | Shared |

| Control | Full | Partial | None |

| Risk of Scams | Low | Low | High |

Understanding the different types of cryptocurrency mining is crucial. Solo mining gives you full control but comes with high costs and low success rates. Pool mining increases your chances of earning rewards but means sharing them with others.

Cloud mining offers an easy start without hardware costs but comes with lower profits and higher risks. Choose the method that best suits your needs and goals in the world of cryptocurrency mining.

Equipment Needed for Cryptocurrency Mining

If you want to start cryptocurrency mining, you’ll need the right equipment. Here’s what you need to know about the hardware and software requirements for mining cryptocurrency.

Hardware Requirements

ASIC Miners:

- Application-Specific Integrated Circuits (ASICs) are specialized devices designed for mining specific cryptocurrencies like Bitcoin. They are very powerful and efficient but can be quite expensive. ASIC miners offer the highest performance for mining but come at a high cost.

GPU Miners:

- Graphics Processing Units (GPUs) are commonly used in gaming computers but can also be used for mining. GPU miners are more versatile than ASICs because they can mine different types of cryptocurrencies. They are less expensive than ASICs but require more setup and maintenance.

| Feature | ASIC Miners | GPU Miners |

|---|---|---|

| Cost | High | Moderate |

| Efficiency | Very High | Moderate |

| Flexibility | Low (specific to one coin) | High (can mine various coins) |

| Setup Complexity | Low | High |

Software Requirements

To mine cryptocurrency, you also need mining software. Here are some popular options:

- CGMiner: One of the oldest and most reliable mining software, CGMiner supports a wide range of mining hardware.

- BFGMiner: Similar to CGMiner but with more advanced features and the ability to mine multiple cryptocurrencies at once.

- NiceHash: An easy-to-use option for beginners, NiceHash automatically chooses the most profitable algorithm to mine.

Additional Tools

Apart from the basic hardware and software, here are some additional tools that can enhance your mining experience:

- Cooling Systems: Mining generates a lot of heat. Effective cooling systems are necessary to keep your equipment running smoothly.

- Power Supplies: Ensure you have a stable power supply that can handle the energy requirements of your mining hardware.

- Mining Pools: Joining a mining pool can increase your chances of earning rewards by combining your computing power with other miners.

Comparison Table: ASIC Miners vs. GPU Miners

| Feature | ASIC Miners | GPU Miners |

|---|---|---|

| Cost | High | Moderate |

| Efficiency | Very High | Moderate |

| Flexibility | Low (specific to one coin) | High (can mine various coins) |

| Setup Complexity | Low | High |

Having the right equipment is essential for successful cryptocurrency mining. Whether you choose ASIC miners for their efficiency or GPU miners for their flexibility, understanding the hardware and software needs will help you get started on the right foot.

Make sure to consider additional tools like cooling systems and stable power supplies to optimize your mining setup.

Setting Up Your Cryptocurrency Mining Rig

Setting up your cryptocurrency mining rig can seem complicated, but it’s a straightforward process if you follow the right steps. Here’s a detailed guide to help you get started.

Choosing the Right Hardware

The first step is choosing the right hardware. Your choice will depend on your budget and mining goals.

- ASIC Miners: Application-Specific Integrated Circuits (ASICs) are built for mining specific cryptocurrencies like Bitcoin. They are highly efficient and powerful but can be expensive. ASIC miners are best if you want maximum performance and are focused on mining one type of cryptocurrency.

- GPU Miners: Graphics Processing Units (GPUs) are more versatile. They can mine a variety of cryptocurrencies and are generally more affordable than ASICs. GPU miners are ideal if you want flexibility and are looking to mine different coins.

| Feature | ASIC Miners | GPU Miners |

|---|---|---|

| Cost | High | Moderate |

| Efficiency | Very High | Moderate |

| Flexibility | Low (specific to one coin) | High (can mine various coins) |

| Setup Complexity | Low | High |

Installing Necessary Software

Once you have your hardware, the next step is to install the necessary software. Here are some popular options:

- CGMiner: This is one of the oldest and most reliable mining software options. It supports a wide range of mining hardware and offers advanced customization features.

- BFGMiner: Similar to CGMiner but with more features for advanced users. It allows you to mine multiple cryptocurrencies simultaneously.

- NiceHash: This software is user-friendly and ideal for beginners. It automatically selects the most profitable algorithm to mine, making it easy to start without much technical knowledge.

Configuration and Optimization

After installing the software, you need to configure and optimize your mining setup for the best performance.

- Connect Your Hardware: Connect your ASIC or GPU miners to your computer. Ensure all connections are secure.

- Configure Mining Software: Enter your mining pool information and wallet address into the software. Joining a mining pool increases your chances of earning rewards by combining your computing power with other miners.

- Optimize Settings: Adjust the settings in your mining software to maximize performance. This includes setting the right mining intensity, power limits, and overclocking your GPUs if possible. Use monitoring tools to track your rig’s performance and make adjustments as needed.

Cooling and Power Supply

Mining hardware generates a lot of heat and consumes significant power. Proper cooling and a stable power supply are essential.

- Cooling Systems: Use fans or liquid cooling systems to keep your hardware at safe operating temperatures. Overheating can damage your equipment and reduce efficiency.

- Power Supply: Choose a high-quality power supply unit (PSU) that can handle the power requirements of your mining rig. Ensure your PSU has enough wattage and the right connectors for your hardware.

Cooling Solutions for Mining Rigs

| Cooling Solution | Pros | Cons |

|---|---|---|

| Air Cooling | Affordable | Less efficient in hot climates |

| Liquid Cooling | More efficient | More expensive and complex setup |

Joining a Mining Pool

Joining a mining pool is crucial for most miners, especially beginners. Here’s why:

- Increased Chances of Rewards: Mining pools combine the computing power of all members, increasing the likelihood of solving the puzzle and earning rewards.

- Steady Income: While solo mining might give you larger rewards occasionally, pool mining provides a more steady income stream as rewards are shared among all participants.

Setting up your cryptocurrency mining rig involves choosing the right hardware, installing necessary software, and optimizing your setup for maximum performance. Whether you opt for ASIC miners for their efficiency or GPU miners for their flexibility, make sure to configure your rig properly and ensure adequate cooling and power supply.

Joining a mining pool can also increase your chances of earning rewards. By following these steps, you can set up a successful mining rig and start earning cryptocurrency.

The Economics of Cryptocurrency Mining

Understanding the economics of cryptocurrency mining is crucial before you start. It involves considering costs, potential profits, and risks.

Costs Involved in Mining

Hardware Costs:

- ASIC Miners: These specialized machines are expensive, often costing thousands of dollars. They provide high efficiency but require a significant upfront investment.

- GPU Miners: These are generally cheaper than ASICs but still require a considerable investment. A good GPU can cost several hundred dollars, and you’ll likely need multiple GPUs for effective mining.

Electricity Costs:

- Mining consumes a lot of electricity. The cost will depend on your location and the type of hardware you use. It’s important to calculate the electricity cost per kilowatt-hour (kWh) in your area to estimate your expenses.

Maintenance Costs:

- Regular maintenance is essential to keep your mining rig running smoothly. This includes cooling systems to prevent overheating, software updates, and occasional hardware repairs.

Profitability and Return on Investment (ROI)

To determine if mining is profitable for you, you need to calculate your return on investment (ROI). Consider the following:

- Current Value of Cryptocurrency: The price of the cryptocurrency you are mining plays a significant role in your potential profits. Keep an eye on market trends and price fluctuations.

- Mining Difficulty: As more miners join the network, the difficulty of solving puzzles increases. Higher difficulty means it takes more time and energy to earn rewards.

- Mining Rewards: This includes block rewards and transaction fees. Block rewards decrease over time (for example, Bitcoin’s halving events), which can affect profitability.

ASIC Miners vs. GPU Miners – Cost Comparison

| Feature | ASIC Miners | GPU Miners |

|---|---|---|

| Initial Cost | High (>$1,000) | Moderate ($300-$800) |

| Electricity Usage | High | Moderate |

| Maintenance | Low | Moderate |

Risk Factors

Mining carries several risks:

- Market Volatility: Cryptocurrency prices can be highly volatile, impacting your potential earnings.

- Regulatory Changes: Laws and regulations regarding cryptocurrency mining can change, potentially affecting your operations.

- Hardware Failure: Mining equipment can fail, leading to unexpected expenses and downtime.

The economics of cryptocurrency mining involve balancing costs and potential profits while managing risks. By understanding hardware and electricity costs, estimating your ROI, and staying informed about market and regulatory changes, you can make more informed decisions about your mining activities.

This knowledge will help you determine if mining is a viable and profitable venture for you.

Legal and Regulatory Aspects of Cryptocurrency Mining

Understanding the legal and regulatory aspects of cryptocurrency mining is crucial. Laws vary by country, and staying compliant is important to avoid potential issues.

Legal Status of Mining in Different Countries

Cryptocurrency mining is treated differently around the world. Here’s a brief overview:

- United States: Mining is generally legal, but regulations vary by state. Some states offer incentives for miners, while others have strict regulations.

- China: China has banned cryptocurrency mining due to energy consumption concerns and financial risks.

- Russia: Mining is allowed, but the government is considering new regulations that could affect miners.

- European Union: The EU has no specific laws against mining, but regulations related to energy consumption and data protection apply.

Regulatory Challenges and Compliance

Mining comes with several regulatory challenges:

- Energy Consumption: Many countries are concerned about the high energy usage of mining operations. Some places impose limits or require miners to use renewable energy sources.

- Taxation: Mining profits are often subject to taxation. In the US, for example, mined cryptocurrency is considered taxable income.

- Environmental Impact: The environmental impact of mining is a growing concern. Some regions require environmental assessments before allowing mining operations.

Legal Status of Mining by Country

| Country | Legal Status | Key Regulations |

|---|---|---|

| United States | Legal (varies by state) | Energy consumption, taxation |

| China | Banned | Total ban on mining activities |

| Russia | Legal (under review) | Potential new regulations on the horizon |

| European Union | Legal | Energy and data protection regulations |

Staying Compliant

To stay compliant with regulations:

- Research Local Laws: Understand the specific laws and regulations in your country or region.

- Use Renewable Energy: If possible, use renewable energy sources to power your mining operations. This can help you comply with energy regulations and reduce environmental impact.

- Keep Records: Maintain detailed records of your mining activities and earnings for tax purposes. This will help you stay compliant with tax regulations.

Navigating the legal and regulatory aspects of cryptocurrency mining is essential for successful and lawful operations.

By understanding the legal status of mining in different countries, staying aware of regulatory challenges, and ensuring compliance, you can minimize risks and avoid potential legal issues.

Future of Cryptocurrency Mining

The future of cryptocurrency mining is shaped by technological advancements, changing regulations, and evolving market dynamics. Here’s what you can expect in the coming years.

Advances in Mining Technology

Technology continues to play a major role in the evolution of cryptocurrency mining:

- More Efficient Hardware: New mining hardware is becoming more efficient. ASIC miners are getting faster and using less electricity. This trend is expected to continue, making mining more accessible and cost-effective.

- Quantum Computing: Quantum computing has the potential to revolutionize mining. Quantum computers can solve complex problems much faster than current hardware. While this technology is still in its early stages, it could significantly impact the mining landscape in the future.

Changes in Mining Algorithms

Mining algorithms are also evolving to address various challenges:

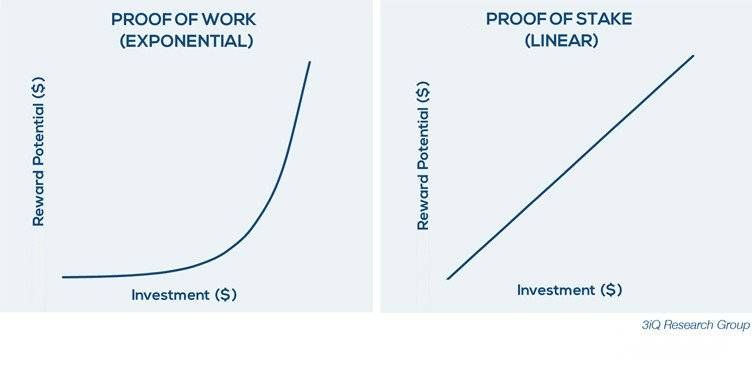

- Proof of Work (PoW) to Proof of Stake (PoS): Many cryptocurrencies are moving from PoW to PoS. PoS is more energy-efficient and environmentally friendly. Ethereum’s transition to Ethereum 2.0 is a prime example of this shift.

- Hybrid Models: Some cryptocurrencies are exploring hybrid models that combine PoW and PoS. These models aim to leverage the strengths of both algorithms while minimizing their weaknesses.

Regulatory Trends

Regulations around cryptocurrency mining are likely to become more stringent:

- Environmental Regulations: Governments are increasingly concerned about the environmental impact of mining. Future regulations may impose stricter controls on energy consumption and carbon emissions.

- Taxation and Legal Compliance: Tax laws and legal frameworks around mining will continue to evolve. Miners will need to stay updated on these changes to remain compliant.

| Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Energy Consumption | High | Low |

| Hardware Requirements | Expensive (ASICs) | Inexpensive |

| Security | High | High |

| Popular Cryptocurrencies | Bitcoin, Litecoin | Ethereum 2.0, Cardano |

Market Dynamics

The market for cryptocurrency mining is becoming more competitive and dynamic:

- Increased Competition: As more people enter the mining space, competition will increase. This could lead to higher mining difficulty and lower profitability for individual miners.

- Decentralization: Efforts to further decentralize mining operations will continue. This helps maintain the security and integrity of blockchain networks.

Energy Consumption Comparison

Understanding the energy consumption of different mining methods is crucial. Here’s a comparison between Proof of Work (PoW) and Proof of Stake (PoS) in terms of energy usage.

| Mining Method | Energy Consumption (kWh per year) | Description |

|---|---|---|

| Proof of Work (PoW) | Very High (e.g., Bitcoin uses around 130 TWh/year) | PoW requires miners to solve complex puzzles, which consumes a lot of electricity. |

| Proof of Stake (PoS) | Low (e.g., Ethereum 2.0 expected to reduce energy use by 99.95%) | PoS selects validators based on the amount of cryptocurrency they hold and are willing to “stake.” |

Energy consumption is a key factor in the sustainability of cryptocurrency mining. PoW methods, like those used by Bitcoin, consume large amounts of electricity, while PoS methods, such as Ethereum 2.0, offer a much more energy-efficient alternative.

As the industry evolves, the shift towards PoS and other energy-efficient models will likely continue, reducing the overall environmental impact of cryptocurrency mining.

Innovations in Renewable Energy

Renewable energy is becoming a key factor in sustainable mining:

- Solar and Wind Power: More miners are turning to solar and wind power to run their operations. These renewable sources can reduce electricity costs and minimize environmental impact.

- Energy-Efficient Mining Farms: New mining farms are being designed with energy efficiency in mind. These farms use advanced cooling systems and optimized layouts to reduce energy consumption.

The future of cryptocurrency mining is set to be shaped by technological advances, regulatory changes, and market dynamics. As mining hardware becomes more efficient and renewable energy use increases, the environmental impact of mining could decrease.

Meanwhile, the shift from PoW to PoS and the development of hybrid models will address many current challenges. Staying informed about these trends will be crucial for anyone involved in cryptocurrency mining.

FAQ Section

What is the best cryptocurrency to mine in 2024?

The best cryptocurrency to mine in 2024 depends on several factors, including market value, mining difficulty, and your hardware. Bitcoin and Ethereum remain popular choices due to their high market values. However, newer coins with lower difficulty levels might offer better profitability. It’s important to research and compare different cryptocurrencies to find the best option for your specific setup and goals.

How to start cryptocurrency mining as a beginner?

To start mining as a beginner, you need to choose the right hardware (ASIC or GPU), install mining software, and join a mining pool. Research thoroughly to understand the costs and benefits.

Start with small investments to minimize risks and gradually scale up as you gain experience. Make sure to stay updated on market trends and technological advancements to optimize your mining process.

Can you mine cryptocurrency on a smartphone?

Yes, you can mine some cryptocurrencies on a smartphone, but it’s not recommended. The processing power of smartphones is much lower than that of dedicated mining hardware, making it inefficient and potentially harmful to your device. Smartphone mining can also drain your battery quickly and overheat the device, leading to long-term damage.

What is the most profitable crypto to mine?

Profitability depends on current market conditions. Bitcoin is often considered the most profitable due to its high value, but other cryptocurrencies with lower mining difficulty may also be profitable. It’s essential to keep an eye on market trends and adjust your mining strategy accordingly. Using profitability calculators can help you determine which cryptocurrency offers the best return on investment at any given time.

How much electricity does crypto mining use?

Crypto mining uses a lot of electricity. The exact amount depends on the type of hardware and the scale of your operation. High-end ASIC miners consume significantly more power than GPU miners. It’s important to factor in electricity costs when calculating potential profits. Using energy-efficient hardware and optimizing your setup can help reduce electricity consumption and improve profitability.

Is cryptocurrency mining legal?

The legality of cryptocurrency mining varies by country. In some places, it is fully legal, while in others, it may be regulated or banned. Always check local laws before starting a mining operation to ensure compliance. Some regions may require licenses or have specific regulations regarding energy consumption and environmental impact.

How long does it take to mine one Bitcoin?

The time it takes to mine one Bitcoin depends on the mining difficulty and the power of your hardware. On average, it takes around 10 minutes to mine a block, but this can vary widely based on your setup. The total time to mine one Bitcoin also depends on the number of miners in the network and the overall hash rate. Higher competition can lead to longer mining times.

What are the risks of cryptocurrency mining?

Risks include high electricity costs, hardware failures, regulatory changes, and fluctuating cryptocurrency prices. It’s important to carefully consider these risks before investing in mining. Additionally, the initial cost of hardware can be significant, and there’s always a risk of reduced profitability due to market volatility or increasing mining difficulty.

How can I reduce the costs of cryptocurrency mining?

To reduce costs, optimize your hardware settings, choose energy-efficient equipment, and consider renewable energy sources. Joining a mining pool can also help distribute costs and increase efficiency. Regular maintenance and updates to your mining software can improve performance and reduce downtime, further lowering overall costs.

What happens when all Bitcoins are mined?

When all 21 million Bitcoins are mined, miners will earn transaction fees instead of block rewards. This shift will change the dynamics of the mining industry but is still several years away. Miners will need to rely on transaction fees to cover their costs and earn profits, which could impact the overall incentive structure of the Bitcoin network.

Final Thoughts: Cryptocurrency Mining

Cryptocurrency mining is an important part of the digital economy, offering potential rewards but also involving significant costs and risks. By understanding the process, equipment, and economics, you can make informed decisions about whether mining is right for you.

As technology evolves, so will the opportunities and challenges in the world of cryptocurrency mining.