Raising financially responsible children is a crucial task for any parent. Teaching kids about money helps them make wise decisions and build a strong foundation for the future. This guide will teach you how to raise financially responsible children by focusing on budgeting, saving, smart spending, and more.

Understanding Financial Responsibility

Definition and Significance

Financial responsibility means knowing how to manage money wisely. It includes understanding how to earn, save, spend, and give money. Teaching children these skills prepares them for a successful and independent life.

Benefits of Financial Education for Children

- Confidence: Learning about money boosts kids’ confidence. They feel more capable when making decisions about spending and saving.

- Independence: Kids who understand finances become less reliant on their parents. They learn to handle their own money, which prepares them for adulthood.

- Future Success: Financially responsible kids are more likely to succeed as adults. They can avoid debt, save for important goals, and make wise investments.

Why It Matters

Children who grow up understanding money management are better equipped to handle life’s financial challenges. They learn the value of hard work and the importance of saving and budgeting. This knowledge can help them achieve long-term financial stability.

Studies show that kids who learn about money early are more likely to save and less likely to incur debt. For example, a study by T. Rowe Price found that 86% of parents who talk to their kids about money see positive behavior changes, such as better saving habits and smarter spending choices.

Teaching your kids about financial responsibility now sets them up for a lifetime of success. It’s never too early to start. Begin with simple concepts and build on them as your child grows. This way, they’ll develop a strong foundation of financial knowledge that will benefit them throughout their lives.

Start Early with Money Lessons

Introduce Money Concepts at a Young Age

Starting early with money lessons is essential for raising financially responsible children. The sooner kids learn about money, the better they will be at managing it. Teaching them the basics of financial responsibility at a young age sets a strong foundation for their future.

Use Simple Activities

Engage your children with simple, hands-on activities to make learning about money fun and easy. Here are a few practical ways to start:

- Counting Coins: Teach your kids to count and recognize different coins. This helps them understand the value of money.

- Piggy Bank: Give them a piggy bank to save their coins. This simple tool can teach them the importance of saving money for future needs.

Interactive Games and Apps

There are many interactive games and apps designed to teach kids about money. These tools make learning about financial responsibility fun and engaging. Apps like PiggyBot and Bankaroo allow kids to manage virtual money, set savings goals, and track their progress.

Parental Involvement

Your involvement as a parent is crucial. Talk to your kids about money regularly. Share your financial experiences and decisions with them. For example, explain why you choose to save money in certain situations or how you budget for family expenses.

Building a Strong Foundation

Starting early with money lessons helps build a strong financial foundation for your children. By introducing these concepts early, you help them develop good habits that will last a lifetime.

Raising financially responsible children begins with teaching them about money from a young age. Use simple activities, practical examples, and interactive tools to make learning fun and effective. Your involvement and guidance will help them understand the importance of financial responsibility and set them on the path to a secure financial future.

Be a Good Role Model

Demonstrate Good Financial Habits

Being a good role model is key to raising financially responsible children. Kids learn a lot by watching their parents. When you show good financial habits, your children are more likely to follow suit. Make it a point to budget wisely, save regularly, and avoid unnecessary debt. This sets a strong example for your kids to emulate.

Discuss Your Financial Decisions Openly and Honestly

Talking openly about money with your kids can have a big impact. Explain your financial decisions in simple terms they can understand. For instance, if you choose to save money instead of buying something new, explain why. This helps children see the value of saving and making thoughtful spending choices.

Here are some practical tips for being a good financial role model:

- Budgeting: Show your kids how you budget your income and expenses. Use a simple spreadsheet or a budgeting app to track your spending. Involve them in the process to make it more engaging.

- Saving: Demonstrate the importance of saving by setting aside a portion of your income regularly. You can even set up a savings jar at home where everyone can contribute.

- Smart Spending: Teach your kids to compare prices and look for deals. Explain why you choose certain items over others based on value and necessity.

A study by the University of Cambridge found that children’s money habits are formed by age 7. By setting a good example early on, you help shape their future financial behavior. For instance, if you always use a shopping list and stick to it, your kids will learn the importance of planning and avoiding impulse buys.

Being a good role model means practicing what you preach. When your children see you making wise financial choices, they will be more inclined to do the same. This is a powerful way to instill financial responsibility and set them up for a successful future.

Teach Budgeting and Saving

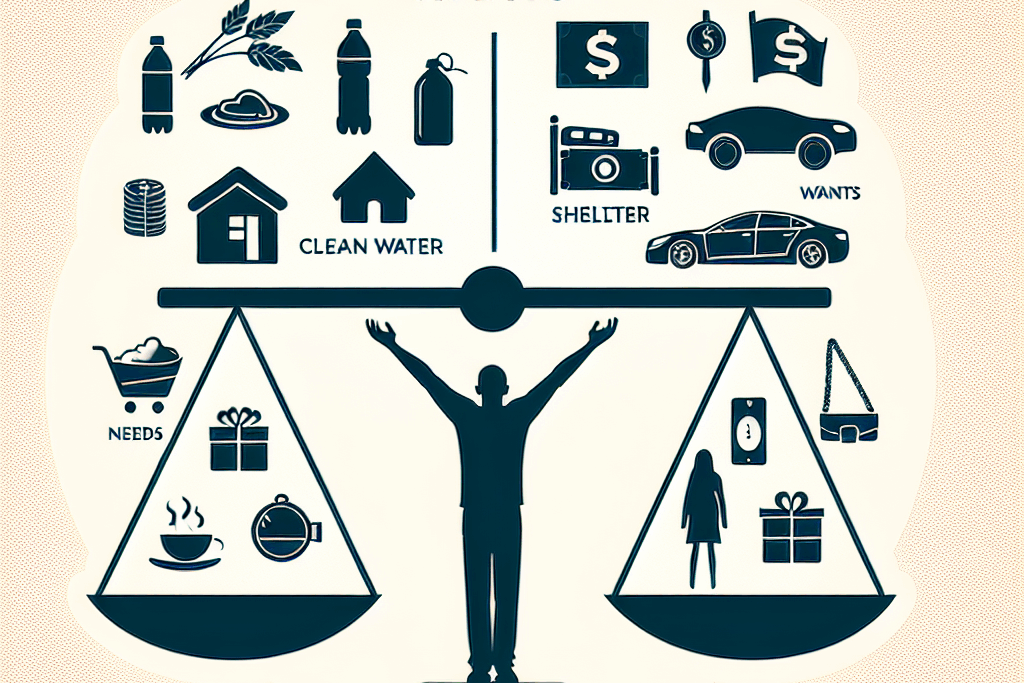

Explain the Difference Between Needs and Wants

Helping children understand the difference between needs and wants is a fundamental step in teaching them budgeting and saving. Needs are things they must have to live, like food, clothing, and shelter. Wants are things they would like to have but can live without, like toys or extra snacks. Understanding this difference helps them prioritize their spending.

Help Children Create a Simple Budget

Creating a budget is a great way for children to learn about managing money. Start with a simple budget that includes their income (allowance or money from chores) and their expenses (savings, spending, and giving). Use a notebook or a simple spreadsheet to track this. Involve them in the process by asking questions like, “How much do you want to save this month?” or “What will you spend your money on?” This teaches them to plan their spending and save for future needs.

Encourage Regular Savings

Teaching children to save regularly helps them develop good financial habits. Here are a few tips:

- Savings Jar: Use a jar where they can deposit their savings. Seeing the money grow can be very motivating for young children.

- Bank Account: For older children, consider opening a savings account. This introduces them to the concept of banking and earning interest on their savings.

Example of Budgeting for Children

Let’s create a simple budget example. Suppose your child receives a weekly allowance of $10. Here’s how they might budget it:

- Savings: $3

- Spending: $5

- Giving: $2

This breakdown helps them allocate their money effectively and understand the importance of saving and giving.

Visual Aids

Using visual aids like charts and graphs can make budgeting more engaging for kids. For instance, a pie chart showing their budget allocation can help them visualize how much they are saving, spending, and giving. This visual representation reinforces the concepts and makes the learning process more enjoyable.

Teaching budgeting and saving is crucial in raising financially responsible children. By explaining the difference between needs and wants, helping them create a simple budget, and encouraging regular savings, you equip them with the tools they need to manage their money wisely.

Use visual aids and practical examples to make these lessons engaging and effective. This way, they will develop strong financial habits that will benefit them throughout their lives.

Make Money Lessons Fun

Turn Financial Education into Games and Interactive Activities

Teaching kids about money doesn’t have to be boring. Turning financial lessons into games and interactive activities can make learning about money fun and engaging. This approach helps children understand important concepts while keeping them entertained.

Use Apps or Board Games to Teach Money Management

There are many apps and board games designed to teach kids about money. These tools can make learning about financial responsibility exciting. Here are some examples:

- Apps: As mentioned before Apps like PiggyBot and Bankaroo allow kids to manage virtual money, set savings goals, and track their progress. These apps provide a hands-on way to learn about budgeting and saving.

- Board Games: Games like Monopoly and The Game of Life teach kids about money management, investing, and making financial decisions. Playing these games as a family can be a fun way to learn about money.

Interactive Activities

Engage your children with activities that teach money management in a playful way. Here are a few ideas:

- Role-Playing: Set up a mock store at home where kids can buy and sell items. Give them play money to use for transactions. This activity teaches them about spending, saving, and making change.

- Savings Challenges: Create a savings challenge where kids compete to save the most money in a month. Reward the winner with a small prize to motivate them.

Practical Example

For example, a study found that children who played financial education games scored higher on financial literacy tests than those who did not. Using games and activities helps reinforce what they learn and makes the lessons stick.

Making money lessons fun is an effective way to teach children about financial responsibility. By using games, apps, and interactive activities, you can make learning about money enjoyable and impactful.

This approach helps kids understand and remember important financial concepts, setting them up for a successful future.

Encourage Smart Spending

Teach Children to Compare Prices and Look for Deals

Teaching children to compare prices and find deals is an essential part of raising financially responsible kids. When they learn to look for bargains, they understand the value of money and how to make it stretch further. Show them how to compare prices online or in stores to get the best deals.

Involve Them in Grocery Shopping and Planning a Budget

Grocery shopping is a practical way to teach kids about smart spending. Let them help with the grocery list and compare prices on different items. Explain why you choose certain brands or products based on price and quality. This hands-on experience teaches them how to plan and stick to a budget.

Examples of Smart Spending

Here’s a simple comparison to illustrate smart spending:

| Item | Brand A (Price) | Brand B (Price) |

|---|---|---|

| Cereal (500g) | $3.50 | $2.50 |

| Laundry Detergent | $10.00 | $7.50 |

| Milk (1L) | $1.80 | $1.50 |

In this example, choosing Brand B for each item saves $3.80 in total. Teaching kids to look for such deals helps them understand how small savings add up.

Real-Life Example

A survey by The National Endowment for Financial Education found that 70% of parents who discuss money with their kids see positive changes in their spending habits. Involving children in real-life shopping decisions helps them practice smart spending and makes them more aware of their financial choices.

Practical Tips

- Set a Budget: Give your kids a set amount of money for a shopping trip and help them stick to it.

- Use Coupons: Show them how to use coupons to save money on purchases.

- Price Tracking Apps: Introduce apps that track prices and notify you of deals, making it easier to find the best prices.

Teaching smart spending habits helps children become more financially responsible. By involving them in everyday financial decisions and showing them how to compare prices and find deals, you equip them with skills that will benefit them throughout their lives.

Teach the Value of Hard Work

Provide Opportunities for Children to Earn Money

Teaching children the value of hard work is essential for raising financially responsible kids. Provide opportunities for them to earn money through chores or small jobs. This not only gives them a sense of achievement but also helps them understand the effort required to earn money.

Explain the Connection Between Work and Earning

Help children understand that money is earned through hard work. This can be done by assigning age-appropriate chores like cleaning their room, washing the dishes, or mowing the lawn. Paying them a small amount for completing these tasks shows them that effort leads to rewards.

Examples of Chores and Earnings

Here’s a simple table showing potential chores and the money earned:

| Chore | Payment |

|---|---|

| Cleaning their room | $2 |

| Washing the dishes | $1 |

| Mowing the lawn | $5 |

| Taking out the trash | $1 |

This approach helps children see the direct link between the work they do and the money they earn. It also teaches them that earning money requires effort and responsibility.

Real-Life Impact

A study by the University of Minnesota found that children who did chores were more likely to become successful adults. By involving kids in household tasks and rewarding them for their efforts, you teach them valuable life skills that go beyond money management.

Practical Tips

- Set Clear Expectations: Make sure your children know what tasks they need to complete and what they will earn.

- Be Consistent: Pay them promptly for their work to reinforce the connection between effort and reward.

- Encourage Persistence: Teach them that not all tasks are fun, but completing them is important.

Teaching children the value of hard work prepares them for future financial responsibilities. By providing opportunities to earn money and explaining the connection between work and earnings, you help them develop a strong work ethic and understand the importance of effort in achieving financial goals.

Introduce Basic Investment Concepts

Explain the Basics of Saving, Interest, and Investments

Teaching children about saving, interest, and investments can seem complicated, but breaking it down into simple concepts can make it easier. Start with the basics of saving. Explain that saving is setting aside money for future needs or wants. Use examples they can relate to, like saving for a toy or a special outing.

Next, introduce the idea of interest. Explain that interest is the money you earn on savings over time. Use a simple example: if they save $10 in a bank account that pays 1% interest per year, they will have $10.10 at the end of the year. This shows them how their money can grow without additional effort.

Use Age-Appropriate Examples to Illustrate These Concepts

To make these concepts more tangible, use age-appropriate examples and tools. For younger children, you can use a piggy bank to show how saving works. For older kids, consider opening a savings account. Show them how interest is added to their savings over time.

Investments: Simple and Understandable

Introduce investments by explaining that it’s another way to grow their money, but it involves a bit of risk. Use the analogy of planting a tree: you plant a small seed (money), take care of it (investment), and over time, it grows into a big tree (more money). Explain that investments can grow more than savings because they have the potential to earn more money, but they also come with the risk of losing some money.

Comparison of Saving vs. Investing

Here’s a simple comparison table to illustrate the differences between saving and investing:

| Aspect | Saving | Investing |

|---|---|---|

| Risk | Low | Medium to High |

| Return | Low (interest) | Potentially High (profits) |

| Liquidity | High (easy to access) | Varies (depends on investment) |

| Time Horizon | Short to Medium | Medium to Long |

This table can help children understand the pros and cons of saving and investing, and when it might be appropriate to choose one over the other.

Practical Example

Consider this example: If a child saves $100 in a bank account with 1% interest, they will earn $1 in a year. If they invest $100 in a stock market and it grows by 10%, they will have $110. However, explain that the stock market can also go down, and they might end up with less than $100. This shows them both the potential and the risk of investing.

Introducing basic investment concepts to children helps them understand how to grow their money. By explaining saving, interest, and investing in simple terms, you give them valuable tools for their financial future.

Use examples, comparisons, and practical activities to make these concepts clear and engaging. This way, they’ll learn to make informed decisions about their money as they grow older.

Foster Gratitude and Generosity

Encourage Children to Give a Portion of Their Money to Charity

Teaching kids about gratitude and generosity is crucial for raising financially responsible children. Encourage them to give a portion of their money to charity. This can be a small part of their allowance or money earned from chores. Explain that helping others is important and that their contribution, no matter how small, can make a big difference.

Teach the Importance of Helping Others

Helping others can teach children the value of money beyond personal use. Explain that giving is not just about money but also about time and effort. Volunteer together at local charities or community events. This hands-on experience helps kids see the impact of their generosity and understand the joy of helping others.

Comparison of Spending vs. Giving

Here’s a simple comparison to show the impact of spending versus giving:

| Action | Personal Benefit | Community Benefit |

|---|---|---|

| Spending | Immediate personal satisfaction | Minimal community impact |

| Giving | Long-term personal fulfillment | Significant positive community impact |

This comparison helps children understand that while spending can provide immediate satisfaction, giving can offer long-term fulfillment and make a positive impact on the community.

Practical Tips

- Set an Example: Be a role model by regularly donating to charity and involving your children in the process.

- Discuss Charities: Talk about different charities and what they do. Let your children choose where they want to donate their money.

- Celebrate Giving: Recognize and celebrate their generosity. This reinforces positive behavior and encourages them to continue giving.

Teaching gratitude and generosity helps children develop a well-rounded approach to money. It instills values that go beyond financial responsibility, fostering a sense of empathy and community.

By encouraging your children to give and helping them understand the importance of helping others, you set them on a path to becoming compassionate and financially responsible adults.

Handling Financial Mistakes

Allow Children to Make Small Financial Mistakes

Allowing children to make small financial mistakes is an essential part of raising financially responsible children. These minor errors teach valuable lessons that will help them make better decisions in the future. When they overspend or forget to save, they experience the consequences firsthand, which can be a powerful learning tool.

Use These Mistakes as Teaching Moments

When your child makes a financial mistake, use it as a teaching moment. Discuss what happened and why it was a mistake. Guide them through the process of understanding the error and how they can avoid it in the future. This approach helps them learn from their experiences without feeling punished.

Examples of Common Financial Mistakes

| Mistake | Learning Opportunity |

|---|---|

| Overspending | Discuss the importance of budgeting and sticking to a plan. |

| Not Saving Enough | Explain the value of saving for future needs and emergencies. |

| Impulse Purchases | Teach them to wait and think before making purchases. |

These examples show how everyday financial errors can become valuable lessons.

Encourage Reflection

Encourage your child to reflect on their financial choices. Ask questions like, “What could you have done differently?” or “How can you plan better next time?” This reflection helps them internalize the lessons learned from their mistakes.

Practical Tips

- Stay Calm: Approach financial mistakes with a calm and supportive attitude.

- Be Supportive: Encourage your child to learn from their mistakes without feeling discouraged.

- Provide Guidance: Offer practical advice on how they can avoid similar mistakes in the future.

Handling financial mistakes positively and constructively teaches children resilience and critical thinking. By allowing them to make small errors and guiding them through the learning process, you help them develop the skills needed to manage their finances wisely.

FAQs

What age should you start teaching children about money?

Start teaching kids about money as soon as they show interest, often around age 3-4. Introduce simple concepts like saving coins and recognizing different denominations. As they grow, you can gradually introduce more complex ideas, such as budgeting and saving for specific goals. Early exposure helps build a solid foundation for financial literacy.

How do you teach kids the value of money?

Show them the difference between needs and wants by involving them in budgeting decisions. Encourage them to earn their money through chores or small jobs. Teach them to save a portion of their earnings and make thoughtful spending choices. These practices help kids understand the effort required to earn money and the importance of managing it wisely.

What are the best financial apps for kids?

Apps like PiggyBot, iAllowance, and Bankaroo are excellent tools for teaching kids about money management in a fun and interactive way. These apps allow children to set savings goals, track their spending, and learn the basics of budgeting. They make financial education engaging and accessible for young learners.

How much allowance should a child get?

A common method is giving $1 per year of age per week. For example, a 10-year-old would receive $10 weekly. Adjust the amount based on your family’s financial situation and goals. Ensure the allowance is enough to teach valuable money management skills without being excessive.

What chores are appropriate for earning an allowance?

Simple chores like cleaning their room, taking out the trash, or helping with dishes are good starting points. These tasks are easy to understand and complete, making them suitable for children of various ages. As they grow older, you can introduce more complex chores to match their abilities and responsibilities.

How can I help my child develop good spending habits?

Teach them to compare prices, look for deals, and think before they spend. Encourage saving for bigger purchases and avoiding impulse buys. Involve them in real-life shopping experiences to practice these skills. By doing so, they learn to make informed decisions and manage their money wisely.

Why is financial literacy important for children?

Financial literacy helps children make informed decisions, avoid debt, and build a secure financial future. Understanding money management early on equips them with the skills needed to handle financial challenges as adults. It fosters independence and confidence in managing personal finances.

How do you explain savings to a child?

Use simple examples like saving coins in a jar to demonstrate how money can accumulate over time. Explain the concept of interest by showing how saved money can grow. Make it a fun and rewarding experience to encourage consistent saving habits.

What are some fun ways to teach kids about money?

Use games, apps, and real-life shopping experiences to make learning about money fun and engaging. Board games like Monopoly and apps like PiggyBot make financial concepts accessible and enjoyable. Involving kids in budgeting for shopping trips also provides practical learning experiences.

How can I involve my child in family financial planning?

Discuss the family budget and involve them in saving for a family goal, such as a vacation. Let them help with grocery shopping by comparing prices and making cost-effective choices. This involvement teaches them about financial planning and the importance of working together towards common goals.

Final Thoughts: How to Raise Financially Responsible Children

Teaching children about financial responsibility is essential for their future success. Start early by introducing basic money concepts and gradually build on this foundation as they grow. Be a good role model by demonstrating smart financial habits and involving them in financial decisions.

Use practical lessons like budgeting, saving, and spending wisely to instill good habits. By raising financially responsible children, you help them develop the skills they need to make informed financial choices. This prepares them for a successful future where they can manage their money effectively and achieve their financial goals.

Additional Resources

- Books: “The Opposite of Spoiled” by Ron Lieber, “Make Your Kid A Money Genius” by Beth Kobliner.

- Apps: PiggyBot, iAllowance, Bankaroo.

- Websites: Moneyasyougrow.org, Junior Achievement.

This guide has provided you with practical steps and tips on how to raise financially responsible children. Start today and watch your kids grow into financially savvy adults