Introduction

A stock market correction happens when stock prices drop by at least 10% from their recent high. Understanding stock market corrections is important for investors because it helps you prepare and react wisely during these times.

In this article, you’ll learn what a stock market correction is, how it differs from other market drops, and how to handle it.

Table of Contents

Understanding Stock Market Correction

Definition of Stock Market Correction

A stock market correction happens when stock prices drop by at least 10% from their recent high. This drop usually occurs over a short period, such as days or weeks. Corrections are a natural part of the market cycle and help to adjust overvalued stocks to more reasonable levels.

They are less severe than bear markets, which involve a decline of 20% or more, and are also different from market crashes, which are sudden and severe drops in prices.

Difference from Bear Market and Crash

A stock market correction is a drop of 10% or more from a recent high, but it’s important to understand how it differs from bear markets and crashes. Let’s break it down:

Stock Market Correction

- Definition: A decline of at least 10% from a recent peak.

- Duration: Short-term, usually a few days to a few months.

- Impact: Often seen as a normal part of the market cycle and can help adjust overvalued stocks.

Bear Market

- Definition: A longer-term decline of 20% or more from recent highs.

- Duration: Can last months or even years.

- Impact: Indicates widespread pessimism and can affect investor confidence for a long time.

Market Crash

- Definition: A sudden, severe drop in stock prices, often more than 20%.

- Duration: Very short-term, usually happening over a few days.

- Impact: Creates panic and significant financial losses. Can lead to long-term economic issues.

Comparison Table

| Term | Definition | Duration | Impact |

|---|---|---|---|

| Stock Market Correction | Drop of 10% or more | Short-term | Normal adjustment, less severe |

| Bear Market | Drop of 20% or more | Long-term | Widespread pessimism, long recovery |

| Market Crash | Sudden, severe drop, often over 20% | Very short-term | Panic, significant losses, potential long-term effects |

Visual Comparison

Common Causes of Stock Market Corrections

Economic Data

Poor economic reports often trigger stock market corrections. When the economy shows signs of weakness, such as low GDP growth, high unemployment rates, or disappointing corporate earnings, investors become worried.

This worry leads to selling stocks, causing prices to drop. For example, if a major company reports lower-than-expected profits, it can cause its stock price to fall, which can then impact the entire market. Investors react quickly to negative news, and this reaction can lead to a correction.

Interest Rates

Rising interest rates are another common cause of stock market corrections. When central banks, like the Federal Reserve, increase interest rates, borrowing money becomes more expensive. Higher interest rates can reduce consumer spending and business investment, which can hurt company profits.

As a result, investors might sell stocks, leading to a drop in stock prices. For instance, if the Federal Reserve raises rates to control inflation, it can make loans and mortgages more costly, slowing down economic growth and triggering a correction.

Geopolitical Events

Geopolitical events, such as wars, political instability, or trade conflicts, can also cause stock prices to fall. These events create uncertainty, and markets do not like uncertainty. For example, a major conflict in a key region can disrupt global supply chains, affecting companies’ operations and profits.

Political unrest in a country can lead to concerns about the stability of its economy, causing investors to sell off stocks. Such events can quickly lead to a market correction as investors seek safer investments.

Historical Examples of Stock Market Corrections

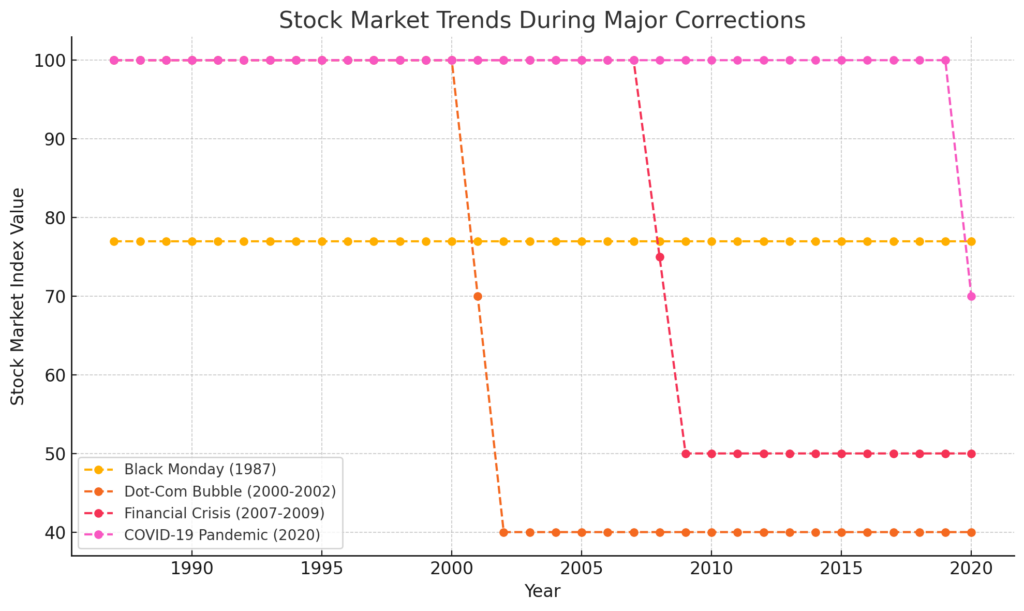

Understanding past stock market corrections can help you prepare for future ones. Let’s look at some notable stock market corrections in history and their impact on investors and the market.

Black Monday (1987)

One of the most famous stock market corrections is Black Monday, which occurred on October 19, 1987. On this day, the Dow Jones Industrial Average (DJIA) dropped by 22.6% in a single day.

This was the largest one-day percentage drop in history. Several factors caused this crash, including computer trading algorithms that sold stocks automatically when prices fell to certain levels.

This created a domino effect, leading to a massive sell-off. Despite this severe correction, the market recovered within a few months, showing the resilience of the stock market.

Dot-Com Bubble (2000-2002)

The dot-com bubble is another significant example of a stock market correction. In the late 1990s, internet-related companies saw their stock prices soar due to high investor expectations.

However, many of these companies had weak business models and couldn’t deliver profits. By March 2000, the bubble burst, leading to a sharp decline in stock prices. The Nasdaq Composite, heavily weighted with tech stocks, fell by nearly 80% over the next two years.

This correction had a long-lasting impact, causing many tech companies to go bankrupt. Investors learned the importance of evaluating a company’s fundamentals before investing.

Financial Crisis (2008)

The financial crisis of 2008 is another example of a major stock market correction. This crisis was triggered by the collapse of the housing market and the failure of large financial institutions.

The DJIA dropped by more than 50% from its peak in 2007 to its low in 2009. This correction led to a global recession, with millions of people losing their jobs and homes.

Governments and central banks around the world took significant measures, such as bailouts and stimulus packages, to stabilize the economy. The market eventually recovered, but it took several years for stocks to reach new highs.

COVID-19 Pandemic (2020)

The C-OV-ID-19 pandemic caused a rapid stock market correction in early 2020. As the virus spread globally, countries went into lockdown, and economic activity slowed down drastically.

In March 2020, the DJIA and other major indexes fell by over 30% within a few weeks. This correction was caused by uncertainty about the pandemic’s impact on the global economy. However, swift actions by governments and central banks, such as financial stimulus and monetary easing, helped the market recover quickly.

By the end of 2020, many stock markets had regained most of their losses.

Impact on Investors and the Market

These historical examples show that stock market corrections can be severe but are often followed by recovery. Corrections can:

- Create Buying Opportunities: Lower stock prices can offer good entry points for long-term investors.

- Highlight the Importance of Diversification: Having a mix of assets can reduce the impact of corrections on your portfolio.

- Teach Valuable Lessons: Each correction provides insights into market behavior and the importance of sticking to a long-term plan.

Visual Representation

Here’s a simple graph illustrating the trends during the major stock market corrections: Black Monday (1987), the Dot-Com Bubble (2000-2002), the Financial Crisis (2007-2009), and the C-OV-ID-19 Pandemic (2020). This visual helps you see how stock prices typically behaved during these periods, showing the drop and recovery patterns for each event.

Understanding these examples can help you navigate future corrections with more confidence and a better strategy.

By learning from the past, you can make informed decisions and manage your investments more effectively during uncertain times.

Signs and Indicators of a Stock Market Correction

Common Signs That Indicate a Stock Market Correction is Coming

Recognizing the signs of a stock market correction can help you prepare and protect your investments. Here are some common indicators that a correction might be on the horizon.

Overvaluation

One of the clearest signs of an upcoming stock market correction is overvaluation. This happens when stock prices are much higher than their actual worth. If companies are trading at high price-to-earnings (P/E) ratios, it might indicate that prices are inflated.

For example, if a company’s P/E ratio is much higher than the average in its industry, it could mean that investors are too optimistic. Overvalued stocks often correct themselves by dropping in price.

Rapid Price Increases

Another sign of a potential correction is rapid price increases. When stock prices rise too quickly, it often leads to a correction.

This is because prices can’t keep rising forever, and a sudden spike usually means that prices will soon fall. For instance, if the stock market has had several days or weeks of continuous gains without any pullbacks, it might be due for a correction. Rapid increases can create bubbles, which eventually burst, leading to a correction.

Low Volatility

Periods of low market volatility can also signal a coming correction. When the market is unusually calm, it can be a sign that investors are complacent.

This complacency can lead to a sudden correction when unexpected news or events occur. For example, if the Volatility Index (VIX), also known as the “fear gauge,” is very low, it might indicate that investors are too relaxed. Low volatility often precedes a spike in market activity, which can trigger a correction.

Key Indicators to Watch For

- Economic Reports: Keep an eye on GDP growth, unemployment rates, and other economic indicators. Poor economic data can signal a correction.

- Interest Rates: Watch for changes in interest rates by central banks. Rising rates can lead to a drop in stock prices.

- Market Sentiment: Pay attention to investor sentiment and market news. High levels of optimism or pessimism can precede corrections.

By recognizing these common signs and keeping an eye on key indicators, you can better prepare for a stock market correction. This awareness allows you to make informed decisions and protect your investments during volatile times.

Effects of Stock Market Corrections

Understanding the effects of stock market corrections helps you manage your investments wisely. Corrections impact the market and investors in both short-term and long-term ways. Let’s explore these effects and how different sectors are affected.

Short-Term Effects on the Stock Market

Stock Price Drop

The immediate effect of a stock market correction is a noticeable drop in stock prices. This decline can lead to panic selling, where investors sell off their stocks to avoid further losses. For instance, if a correction starts and prices fall by 10% or more, many investors might rush to sell, causing prices to drop even further. This can lead to a volatile market environment.

Increased Volatility

During a correction, the market experiences higher volatility. Stock prices can swing wildly within short periods, making it hard for investors to predict market movements. This increased volatility can be stressful for investors and can lead to impulsive decisions. It’s essential to stay calm and avoid making hasty moves based on daily market swings.

Investor Sentiment

Corrections often lead to negative investor sentiment. As prices drop, confidence in the market can wane. This lack of confidence can cause further selling and can delay the market’s recovery. Negative news and media coverage can amplify these sentiments, making the correction feel more severe than it might be.

Long-Term Effects on the Stock Market

Market Recovery

Despite the short-term turmoil, markets typically recover from corrections. The recovery process can take weeks, months, or even years, depending on the severity of the correction and the underlying economic conditions. Historical data shows that markets have always bounced back, often reaching new highs after a correction.

Improved Valuations

One positive long-term effect of corrections is improved stock valuations. When prices drop, overvalued stocks return to more reasonable levels. This correction helps the market stabilize and prevents bubbles from forming. For example, after a correction, stocks that were previously expensive may become attractive investments again, drawing in new buyers.

Stronger Companies

Corrections can also lead to stronger companies. During these times, weaker companies might struggle to survive, while stronger, well-managed companies can endure the downturn. This natural selection process can lead to a healthier market in the long run, as only the most resilient companies thrive.

How Corrections Affect Different Sectors

Technology Sector

The technology sector often sees significant impacts during corrections due to high valuations. Tech stocks can experience sharp declines, but they also tend to recover quickly due to strong growth potential. For example, during the dot-com bubble burst, many tech stocks plummeted, but the sector eventually rebounded, with some companies becoming industry leaders.

Consumer Staples

Consumer staples, such as food and household products, are typically less affected by corrections. These stocks are considered defensive because people continue to buy essential goods regardless of economic conditions. As a result, consumer staples stocks can provide stability during volatile times.

Financial Sector

The financial sector can be heavily impacted by corrections, especially if the correction is tied to economic issues like interest rates or a financial crisis. Banks and financial institutions might see their stock prices drop significantly. However, these stocks can also rebound strongly as the economy recovers.

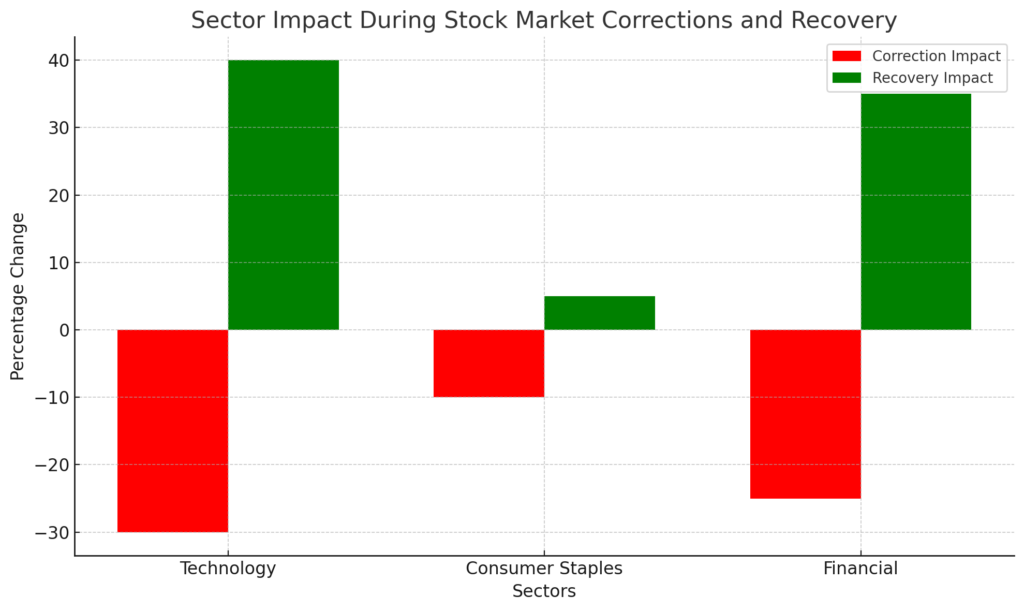

Visual Representation

Here’s a visual representation of how different sectors respond during corrections:

Here’s a visual representation showing how different sectors respond during stock market corrections and recoveries. The graph illustrates the percentage change in stock prices for the Technology, Consumer Staples, and Financial sectors during these periods.

- Technology Sector: Often sees a significant drop during corrections but also a strong rebound during recovery.

- Consumer Staples: Experiences smaller declines during corrections and modest gains during recovery.

- Financial Sector: Can be heavily impacted during corrections but tends to recover strongly as the economy improves.

Understanding these patterns can help you make informed investment decisions during market corrections.

How to Prepare for a Stock Market Correction

Preparing for a stock market correction is crucial to protect your investments and stay calm during market volatility. Here are some strategies to help you get ready.

Diversification

One of the best ways to prepare for a stock market correction is to diversify your portfolio. This means spreading your investments across different asset classes, sectors, and geographic regions.

For example, instead of putting all your money into tech stocks, you might invest in a mix of tech, consumer goods, and bonds. Diversification can help reduce risk because not all investments will be affected equally by a correction.

Risk Management

Managing risk is another key strategy. You can do this by setting stop-loss orders, which automatically sell a stock if its price falls below a certain level. This helps limit potential losses.

Additionally, consider your risk tolerance and adjust your portfolio accordingly. If you’re close to retirement, you might want to have a more conservative portfolio with more bonds and less stock.

Long-Term Investment Plan

Having a long-term investment plan is essential. Corrections are a normal part of the market cycle, and the market has historically always recovered.

By focusing on long-term goals, you can avoid making impulsive decisions during short-term market downturns. Stick to your plan and remember that investing is a marathon, not a sprint.

What to Do During a Stock Market Correction

When a stock market correction happens, it can be stressful. But knowing what to do can help you stay calm and make smart decisions.

Stay Calm and Avoid Panic Selling

First, it’s crucial to stay calm. Panic selling can lead to losses. When stock prices drop, it’s natural to want to sell everything to avoid further losses. But remember, corrections are normal, and the market usually recovers. Selling in a panic can lock in losses that might have been temporary.

Review Your Portfolio

Take this time to review your portfolio. Check if your investments still align with your long-term goals. If you have some extra cash, a correction can be a good opportunity to buy quality stocks at lower prices. Look for companies with strong fundamentals that are likely to bounce back.

Focus on Diversification

Make sure your portfolio is well-diversified. If you find that you have too much invested in one sector or stock, consider spreading your investments out. Diversification can help protect your portfolio from large losses in any single investment.

Keep a Long-Term Perspective

Remember to keep a long-term perspective. Corrections are temporary, and the market has historically recovered and grown over time. Stick to your investment plan and avoid making impulsive decisions based on short-term market movements.

By staying calm, reviewing your portfolio, focusing on diversification, and maintaining a long-term perspective, you can navigate a stock market correction wisely.

These steps can help you protect your investments and take advantage of opportunities during market downturns.

Recovering from a Stock Market Correction

Recovering from a stock market correction requires patience and strategy. Knowing how markets typically recover and having a plan can help you bounce back stronger. Let’s explore how markets recover and some strategies for rebuilding your portfolio.

How Markets Typically Recover After a Correction

Gradual Recovery

After a stock market correction, recovery is often gradual. The market doesn’t rebound overnight. Instead, prices slowly climb back up as investors regain confidence. Historical data shows that corrections are usually followed by periods of growth.

For example, after the financial crisis of 2008, the market took several years to fully recover, but it eventually reached new highs.

Improved Market Conditions

Recoveries are often supported by improved economic conditions. As companies report better earnings and economic indicators improve, stock prices start to rise. For instance, during the recovery from the C-OV-ID-19 pandemic in 2020, government stimulus packages and monetary easing helped boost market confidence, leading to a quick rebound in stock prices.

Strategies for Rebuilding Your Portfolio

Rebalance Your Portfolio

Rebalancing your portfolio is an essential step after a correction. This involves adjusting your investments to ensure they align with your risk tolerance and long-term goals. For example, if certain stocks have dropped significantly, you might consider buying more of those stocks at lower prices.

This strategy, known as dollar-cost averaging, can help reduce your average cost per share over time.

Diversify Your Investments

Diversification is crucial in recovery. By spreading your investments across different sectors and asset classes, you can reduce risk and improve your chances of recovery. For instance, if you were heavily invested in tech stocks and they took a hit, diversifying into consumer staples or healthcare can balance your portfolio. A well-diversified portfolio is better equipped to withstand future corrections.

Focus on Quality Stocks

During a recovery, focus on investing in quality stocks. These are companies with strong fundamentals, such as solid earnings, low debt, and good management. Quality stocks tend to recover faster and perform better in the long run.

For example, blue-chip companies like Apple and Microsoft have shown resilience during market downturns and have a history of strong performance.

Maintain a Long-Term Perspective

Keeping a long-term perspective is vital. Stock market corrections are temporary, and the market has historically recovered and grown over time. Avoid making impulsive decisions based on short-term market movements. Stick to your investment plan and remember your long-term goals. Over time, the market tends to reward patience and disciplined investing.

Avoiding Common Mistakes

Panic Selling

One of the biggest mistakes during a recovery is panic selling. Selling your investments out of fear can lock in losses and prevent you from benefiting from the recovery. Instead, stay calm and stick to your strategy.

Chasing Performance

Avoid chasing the latest high-performing stocks. This can lead to buying at high prices and potentially facing future losses. Focus on your investment plan and avoid making decisions based solely on recent performance.

Recovering from a stock market correction involves strategic planning and maintaining a long-term outlook. By rebalancing your portfolio, diversifying your investments, and focusing on quality stocks, you can navigate the recovery phase effectively.

Stay patient, avoid common mistakes, and remember that the market has always bounced back, often stronger than before.

Common Myths About Stock Market Corrections

There are many myths about stock market corrections that can cause confusion and anxiety for investors. Understanding the reality behind these myths can help you make better investment decisions. Let’s debunk some common misconceptions.

Myth 1: Corrections Are Rare Events

One common myth is that stock market corrections are rare. In reality, corrections happen quite often. On average, the market experiences a correction of at least 10% once every 1-2 years. These corrections are a normal part of the market cycle and help adjust overvalued stocks to more reasonable prices.

Myth 2: Corrections Always Lead to Bear Markets

Another myth is that a correction will always lead to a bear market. While some corrections do lead to longer-term downturns, most do not. A bear market is defined as a decline of 20% or more, and it usually lasts much longer than a correction. Most corrections are short-term and followed by a market recovery.

Comparison Table: Correction vs. Bear Market

| Feature | Correction | Bear Market |

|---|---|---|

| Decline | 10% or more | 20% or more |

| Duration | Short-term (weeks/months) | Long-term (months/years) |

| Frequency | 1-2 years | Less frequent |

Myth 3: You Should Sell Everything During a Correction

Some believe that selling all investments during a correction is the best way to avoid losses. However, this strategy can be harmful. Selling in a panic can lock in losses and prevent you from benefiting from the market’s eventual recovery. Instead, focus on your long-term investment plan and avoid making impulsive decisions based on short-term market movements.

Myth 4: Corrections Are Predictable

Many people think they can predict when a correction will happen. While some indicators can signal a potential correction, it’s impossible to predict the exact timing with certainty. The best approach is to be prepared and have a diversified portfolio that can withstand market volatility.

By understanding these myths and the realities behind them, you can approach stock market corrections with more confidence and make informed decisions.

Remember, corrections are a natural part of investing, and staying calm and focused on your long-term goals is the best strategy.

Stock Market Correction vs. Market Volatility

Understanding the difference between a stock market correction and market volatility is important for investors. Both terms describe changes in the market, but they are not the same.

Stock Market Correction

A stock market correction happens when the market drops by at least 10% from its recent high. This drop is usually a response to overvaluation, economic data, or geopolitical events. Corrections are short-term and often last a few weeks or months. They are a natural part of the market cycle and help adjust prices to more realistic levels.

Key Points:

- Definition: A 10% or more drop from a recent high.

- Duration: Typically short-term (weeks to months).

- Cause: Overvaluation, economic data, geopolitical events.

Market Volatility

Market volatility refers to the frequent and sometimes sharp fluctuations in stock prices. Volatility can happen in any market condition, whether the market is rising, falling, or stable. It is measured by the Volatility Index (VIX), also known as the “fear gauge.” High volatility means significant price changes in a short period, while low volatility means stable prices.

Key Points:

- Definition: Frequent and sharp price changes.

- Duration: Can occur at any time, regardless of market trend.

- Cause: Investor sentiment, economic reports, unexpected events.

| Feature | Stock Market Correction | Market Volatility |

|---|---|---|

| Decline | 10% or more | Can be any size |

| Duration | Short-term | Any time |

| Cause | Specific events | Investor sentiment |

Understanding these differences helps you manage your investments better. Corrections are part of the market cycle, while volatility can happen anytime. By knowing what each term means, you can stay calm and make informed decisions during market changes.

Role of Government and Policy in Stock Market Corrections

Government actions and policies play a significant role in how stock market corrections unfold and how quickly markets recover. Understanding this role can help investors navigate these periods with more confidence.

Government Interventions

Monetary Policy

One of the main tools governments use to manage stock market corrections is monetary policy. Central banks, like the Federal Reserve in the U.S., adjust interest rates to influence economic activity.

During a correction, central banks might lower interest rates to make borrowing cheaper, encouraging businesses to invest and consumers to spend. This can help boost the economy and support a market recovery.

Fiscal Policy

Governments also use fiscal policy to address stock market corrections. This includes changes in government spending and taxation. For instance, during the 2008 financial crisis, many governments introduced stimulus packages to support the economy.

These packages often include spending on infrastructure, tax cuts, and direct payments to individuals, which can help stabilize the market.

Regulatory Measures

Market Regulations

To prevent excessive volatility and ensure market stability, governments enforce regulations on trading practices. These regulations can include circuit breakers, which temporarily halt trading if prices drop too quickly. Circuit breakers give investors time to assess the situation and make more informed decisions, reducing panic selling.

Bailouts and Support

In some cases, governments provide bailouts to struggling industries or financial institutions. These actions can prevent the collapse of critical sectors, maintaining investor confidence. For example, during the C-O-VID-19 pandemic, governments around the world provided significant support to airlines, banks, and small businesses to keep them afloat.

Examples of Government Actions

The 2008 Financial Crisis

During the 2008 financial crisis, the U.S. government took several measures to stabilize the market. The Federal Reserve lowered interest rates to nearly zero and launched the Troubled Asset Relief Program (TARP) to inject capital into banks. These actions helped restore confidence and led to a market recovery.

COVID-19 Pandemic Response

In response to the economic impact of the C-OVI-D-19 pandemic, governments worldwide implemented various measures. In the U.S., the Federal Reserve cut interest rates and introduced quantitative easing to increase liquidity.

Additionally, the CARES Act provided direct payments to individuals, unemployment benefits, and support for businesses. These actions helped mitigate the economic downturn and supported the stock market recovery.

Impact of Stock Market Corrections on the Economy

Stock market corrections can have significant effects on the economy. Understanding these impacts can help you see the bigger picture and make informed decisions during such times.

Effect on Employment

When the stock market corrects, companies may experience reduced profits. This can lead to cost-cutting measures, such as layoffs or hiring freezes.

For example, during the 2008 financial crisis, many businesses had to reduce their workforce to cope with lower revenues. This increase in unemployment can decrease consumer spending, further slowing down economic growth.

Consumer Confidence

Stock market corrections can also affect consumer confidence. When people see their investments and retirement savings lose value, they may become more cautious with their spending. Lower consumer confidence can lead to reduced demand for goods and services, impacting businesses and slowing economic activity.

Comparison Table: Effects on Employment and Consumer Confidence

| Aspect | Employment Impact | Consumer Confidence Impact |

|---|---|---|

| Description | Layoffs, hiring freezes | Reduced spending, cautious behavior |

| Example | 2008 financial crisis layoffs | Decreased demand for goods |

Business Investment

Businesses often rely on stock market performance to fund expansion projects. When a correction occurs, companies may face difficulty raising capital. This can result in delayed or canceled projects, which can slow down economic growth.

For instance, during periods of market instability, companies might postpone opening new branches or investing in new technology.

Broader Economic Implications

Stock market corrections can also have broader economic implications. Reduced consumer spending, lower business investment, and increased unemployment can all contribute to a slowdown in economic growth.

In severe cases, if these factors persist, they can lead to a recession. However, it’s important to remember that corrections are a normal part of the market cycle and economies typically recover over time.

By understanding the impact of stock market corrections on employment, consumer confidence, and business investment, you can better navigate these periods and make informed financial decisions.

Remember, staying informed and maintaining a long-term perspective is key to managing your investments through market fluctuations.

FAQ

What is a 10% stock market correction?

A 10% stock market correction is when stock prices drop by 10% or more from their recent peak. This decline is considered normal and is part of the market’s natural cycle. Corrections help to adjust the prices of overvalued stocks and bring them back to more realistic levels. While they might seem alarming, they are a common occurrence and are not usually a sign of a long-term downturn.

How often do stock market corrections occur?

Stock market corrections typically happen every one to two years. These corrections are a regular part of the market cycle and help to prevent the formation of bubbles. They serve as a reset, allowing the market to cool off after periods of rapid growth.

Understanding that corrections are frequent can help investors stay calm and avoid making hasty decisions based on short-term market movements.

What should you do during a market correction?

During a market correction, it’s crucial to stay calm and avoid panic selling. Stick to your long-term investment plan and review your portfolio to ensure it aligns with your goals. Corrections can offer opportunities to buy quality stocks at lower prices. By maintaining a long-term perspective, you can make more informed decisions and avoid the pitfalls of emotional trading.

How long do stock market corrections last?

Stock market corrections usually last from a few weeks to several months. The exact duration can vary depending on the underlying causes and the overall economic conditions. While some corrections are brief, others can take longer to resolve.

Keeping a long-term perspective and understanding that corrections are temporary can help you navigate these periods without undue stress.

Can you predict a stock market correction?

Predicting a stock market correction is very difficult. While there are indicators and signs that a correction might be coming, the exact timing and extent are hard to forecast.

Many factors influence the market, and unexpected events can trigger corrections. It’s more important to be prepared and have a diversified portfolio that can weather market volatility.

What is the difference between a correction and a crash in the stock market?

A correction is a decline of 10% or more from a recent high, while a crash is a sudden and severe drop of 20% or more. Corrections are common and part of the market’s natural cycle, helping to adjust prices. Crashes are more extreme and can have longer-lasting impacts on the market and the economy.

How much does the stock market drop in a correction?

In a stock market correction, prices typically drop by 10% to 20%. This level of decline is enough to adjust overvalued stocks but not as severe as a bear market. Corrections help to realign stock prices with their true value, offering opportunities for investors to buy at lower prices. They are a normal part of the investing landscape and should be expected periodically.

Is a stock market correction a good time to buy?

Yes, a stock market correction can be a good time to buy quality stocks at lower prices. During corrections, even strong companies can see their stock prices fall, creating buying opportunities for long-term investors.

It’s important to focus on the fundamentals of the companies you invest in and not try to time the market. Having a long-term perspective can help you take advantage of these opportunities.

What happens to your 401k during a stock market correction?

During a stock market correction, the value of your 401k may drop. However, if you are investing for the long term, your investments should recover as the market rebounds. It’s important to continue contributing to your 401k and not make hasty decisions based on short-term market fluctuations. Staying the course and maintaining a diversified portfolio can help you achieve your retirement goals.

Are stock market corrections healthy for the economy?

Stock market corrections can be healthy for the economy as they prevent bubbles from forming and help maintain market stability. Corrections allow for necessary adjustments in stock prices, leading to more sustainable growth.

By cooling off an overheated market, corrections can create a more stable investment environment, benefiting long-term economic health.